|

Step

1: Estimate the home's market value

Step

2: Find out if home prices in your area have been rising or

falling

Step

3: Estimate what you think the home's worth

Step

4: Consider

your bargaining position

Step 5: Decide

on an offer price

Step 6: Decide how to make the offer

Step 7: Make the offer

Step 8: What to do if your offer isn't accepted

What

to do when you want to come up with a fair price for both parties

Advanced

negotiating tactics

You've

found the perfect house, checked it out carefully, and slept on the decision to

buy it. Now it's time to make an offer.

Step

1: Estimate

the home's market value

The asking price is typically set about 1-10% above the seller's

estimate of its market value. But sellers can get that wrong, and

they're sometimes willing to accept offers that are well below the

asking price. To estimate the home's market value, I

recommend that you collect data from various sources:

-

Get

a $29.95 Complete Property Valuation from electronicappraiser.com.

-

Get

free online appraisals of the property from Zillow.com,

realestateabc.com, and Ditech.com. (On the

Ditech website, click on "Calculators," and then click on "Free

eAppraisal.")

These websites don't reveal their appraisal methodology, but I

think it's based on taking the last sales price for the property and scaling it upward or downward according to how

average property prices in the neighborhood have changed.

If the owner has spent a lot of money remodeling the house, you should fudge the estimates up accordingly.

I found that

Zillow gave fairly good estimates for houses in subdivisions but

poor estimates for houses with unique attributes, like

custom-built homes on scenic lots. Zillow allows you to

review the details they have about your home (Click on the

"See home details" link) and edit them.

-

Get

information about "comparables"--houses that are

similar to the one you want to buy that have sold recently. Zillow.com

and realestateabc.com

are good sources. (Click the "Map comparable

homes" link.) So is realestate.yahoo.com

(Click on What's My Home Worth? in the Tools section on the left

hand side.) Create a separate fact sheet for each comparable,

then drive (or better yet, walk) by all of the

homes and compare them to the one you want. Try

to guess how much more or less your dream house is worth compared to each of

them, then use these guesses to fudge

the actual sales prices of the comparables into estimates of

your home's market value.

| Don't rely too

much on online appraisals. Here are the estimates I got

from some online appraisal services for four different

properties in California:

A custom house in the city,

last sold in 1998:

- Zillow.com: $990,120

- RealestateABC.com:

$958,000

- Ditech.com:

$793,000-$975,000

A custom house with scenic view

on the coast, last sold in 2002:

- Zillow.com: $467,007

- RealestateABC.com:

Insufficient data

- Ditech.com: $562,000 -

$727,000

A tract home, last sold in

1983:

- Zillow.com: $492,520

- RealestateABC.com:

$490,000

- Ditech.com: $515,000 -

$595,000

A tract home, last sold in

2005:

- Zillow.com: $405,040

- RealestateABC:

$432,000

- Ditech.com: $405,000 -

$498,000

|

|

Other

sources won't be of much help, either. I

examined three reports by certified appraisers that were based on adjusting the sales

prices of comparables that had sold recently to account for

differences between them and the subject property. The

adjusted sales prices often varied by quite a bit:

|

Property

|

Adjusted

sales prices

of comparables |

Appraised

value

|

|

#1 |

$717,500

$671,500

$720,000 |

$700,000 |

|

#2 |

$138,500

$148,175

$148,955 |

$148,000 |

|

#3 |

$476,180

$507,380

$541,150 |

$475,000* |

|

*This

property had just sold for $475,000 and the purpose of the

appraisal was to reassure the lender that the price was

reasonable. |

|

Step

2: Find out if home prices in your area have been rising or

falling

Go

to the website of the National

Association of Realtors and click on the Existing Home Sales link on

the lower left hand side of the page. Look at the Existing Home

Sales and Pending Home Sales reports and see whether prices in your area have appreciated or depreciated.

Don't put too much stock in this information, though:

-

The

home prices reported by the NAR can rise not just because of

supply and demand, but also because more expensive homes are being

built in the area or because people are making improvements to their

existing homes. Ideally, we'd like to use a price index that

shows how much a typical house in your price range would have

appreciated or depreciated over time if no home improvements were

made.

-

Home

prices might be sticky downward. If a market is falling, you

might not be able to see how weak it is for several months.

That's because home sellers have trouble facing the fact that their

homes have depreciated. What you see instead is that homes

stay on the market for longer periods of time.

-

Many sellers (and builders) have been offering generous incentives

and credits to sell their homes. So while the statistics are showing

just modest drops in sales prices, the amounts sellers are actually

netting have been dropping by quite a bit more.

-

The NAR and other

reporting agencies use median rather than average prices.

These can understate the severity of the downtown if

higher-end homes

sell better than starter homes. Indeed, it's even possible

for the median sales prices to rise in an area where all home prices

are falling.

|

Here’s

an extreme example that shows how it's possible for

median prices to rise even as average prices are falling:

Suppose

that there are just two kinds of properties in the town of Homesville: luxury homes and starter homes. In 2005, 200 luxury

homes were sold for $800,000 each and 300 starter homes were sold

for $400,000 each. In 2007, 150 luxury homes were sold for $600,000

each and 100 starter homes were sold for $300,000 each. Even though

the prices of all homes in Homesville dropped by 25% between 2005

and 2007, the median sales price rose from $400,000 to $600,000.

Moral: Don't rely too much on median price data. |

Use

this information to make adjustments to your market value

estimates. For example, if you based an estimate on sales

data that were six months old and if you believe that prices have

risen by 10% over the past six months, then adjust the market value

estimate upward by 10%.

Step

3: Estimate what you think the home's worth

This

value may be more or less than the home's market value, but bear in mind

that lenders sometimes won't approve loans if the sales price is much

higher than the appraised market value.

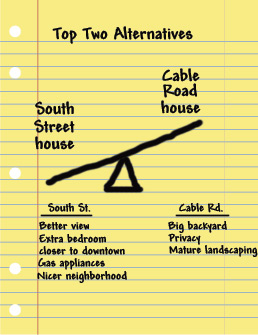

A

good way to figure out what the home is worth to you is to weigh your alternatives against

one another. Suppose you're interested in a house on South Street,

but you also like a smaller one on

Cable Road. Write down the benefits of the two choices on a piece

of paper. Here's how your notes might look:

This

diagram shows that, to you, the benefits of the South Street house outweigh those

of the Cable

Road house.

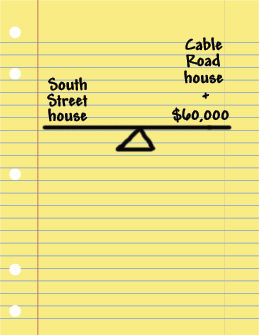

Now

try to imagine how much money you would need to add to the Cable

Road house in order to make the two properties equally appealing to you.

For example, if you added $100,000 to the Cable Road house, would that

make it more appealing to you than the South Street house? Keep

testing different numbers until you come up with a number that exactly

balances the two sides, like this:

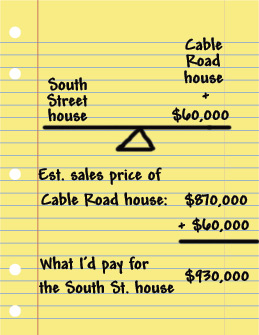

Now

guess the market value of the Cable Road house (say $870,000) and do some algebra. Think of the

balance's fulcrum as an equal sign and solve for the value of the South Street

house. In this case, the equation would read: South Street house = Cable Road

house + $60,000. Substituting in your estimate of the price of the

Cable Road house, you'll get a value for the South Street house of

$870,000 + $60,000 = $930,000.

The

sum, $930,000, gives you an estimate of the maximum price you should pay

for the South Street house, based on the assumption that you could buy the Cable Road

house for $870,000.

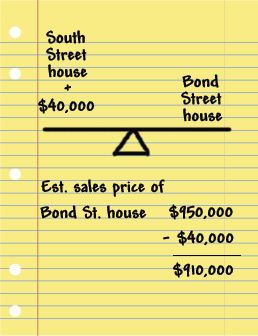

Now

do the same exercise with one or two other options. Perhaps

one would be to buy the Bond Street house, which you prefer by

$40,000 to the South Street house:

Again,

use algebra to solve for the value of the South Street house.

Here's the equation: South Street house + $40,000 = Bond Street

house. If you

estimate that the Bond Street house would go for $950,00, then the value

to you of the South Street house is $950,000 - $40,000 = $910,000.

This means that the most you should pay for the South Street house is $910,000,

assuming you could buy the Bond Street house for $950,000.

|

When

deciding how much a house is worth to you, consider renting as

an option.

See The Buy vs.

Rent Decision by Suze Orman for help

in thinking this through. |

Step

4: Consider

your bargaining position

My

husband is a good negotiator, but it's agonizing to watch him in action.

He sometimes starts low--really low. The buyer's agent (or car

salesperson) invariably looks crestfallen. I don't say anything during

these negotiations, but I always feel faintly ashamed and embarrassed.

After wasting hours or even days of the salesperson's time, we're finally

revealing ourselves to be flaky and unrealistic.

But

we often end up getting terrific deals.

|

Buyers'

agents will often act disappointed or annoyed if you want to make a low offer. Pay no attention. |

Of

course, we don't always make low offers. Once, we even made a full-price

offer with no contingencies on a lot that we absolutely had to

have. There were no other lots like it and we were afraid we'd

lose it to another buyer.

Whether

or not you can start low depends on the strength of your bargaining position. Here are some factors that would give

you a strong bargaining position:

-

If

the

house has been on the market for a long time.

-

If

there

are other, similar houses in the neighborhood.

-

If

you're

likely to be able to close the deal in a timely manner.

-

If

you're

interested in more than one house.

-

If

you're in no hurry to buy a house.

If

your bargaining position is weak, it will be harder to get a good deal.

That's why it's a good idea to strengthen your position before you begin

negotiations. One way to do this is to sell your existing home before you begin

searching for a replacement. Another is to go a mortgage lender

and get pre-approved for a loan so you can demonstrate your ability to buy

the house. Finally, you should look at lots of houses and try to find several that are

acceptable to you.

|

If

you fall in love with a unique home that's fresh

on the market, try to act relaxed and unrushed so the

seller won't grasp the weakness of your position. |

Step 5: Decide

on an offer price

If

your bargaining position is strong, try subtracting 10% from either your

estimate of the market value or the asking price--whichever is lower.

Suppose, for example, the asking price was $950,000 and your estimate of the home's

market value was $920,000. I'd recommend that you consider a

starting offer of $830,000 (which is roughly 90% of $920,000). Before

making this offer, verify that the offer falls below your lowest estimate of what the house is worth to you ($910,000 in our

example). If it doesn't, lower it.

If

your bargaining position is weak, or if the housing market is hot in your

area, you'll probably want to make an offer that's much closer to the asking

price. And if the market is very hot, you may want to make an offer

that's above the asking price.

Step 6: Decide

how to make the offer

Here

are your options for FSBO properties:

|

A

buyer's agent showed you the house. |

The

agent is probably entitled to the commission. Make the

offer through him or her. |

|

You visited an open house that was hosted by a real estate agent. |

The

agent hosting the open house may try to claim some or all of the buyer's agent's

commission. |

|

No

agent showed you the house. |

You don't need to make an offer through a licensed agent.

You can make an offer directly, or (for a flat fee) through a

discount agent or lawyer. If the seller is offering a buyer's agent's

commission, you can arrange to have it waived or to have most of

it rebated back to you. |

To find

a lawyer, go to Lawyers.com and look under REAL ESTATE>Buying or Selling a Home,

or go to Findlaw.com and look for a real estate lawyer who specializes

in transactions. These lawyers will sometimes offer to represent you for

a share of the buyer's agent's commission (say, 1%) or a flat fee, but you can usually do

better if you pay the lawyer by the hour. A typical fee in my area is

$200 an hour.

Since

$200 an hour comes to over $3 a minute, I suggest you arrive at the lawyer's

office well prepared. Begin by getting a standard form Offer to Purchase

Real Estate for your state (you can usually download these from Nupplegal.com),

read it carefully, and fill it out to the best of your ability. The

lawyer's job should be to go over the contract with you and look for

problems.

If

you're working with an agent, don't share your negotiating

strategy. As I've noted, "your" agent may actually be

representing the seller. If you share your strategy, the agent

might have a fiduciary duty to share that information with the

seller.

Step

7: Make the offer

Here's

what to expect when you make an offer:

-

You'll

be asked to give an offer price for the property.

-

You'll

be asked to explain how you plan to pay for the property. (As I

noted earlier, appending a pre-approval letter from a bank costs you

little and sweetens your offer.)

-

You'll

be asked to write a check payable to the seller as an earnest money deposit, usually for

3-5% of the offer price, and even more in a hot market. The lawyer or agent will hold onto the

check during the price negotiations. If your offer is accepted and

you later default on the contract, you'll forfeit the deposit.

-

Your broker or lawyer will probably add some contingencies to the contract so that will

let you walk away from the deal if something goes wrong. For

example, you’ll want to get out of the deal if you can’t get

financing, or if there’s something wrong with the house that wasn’t

disclosed. This

article talks about the importance of these two contingencies.

-

The

contract will specify who pays for various closing

costs. These expenses are often allocated according to local

customs.

-

The

contract will establish a timetable for completing the deal.

-

The

contract will set a date for when you can move in.

-

The

contract will specify who is responsible for any repairs or improvements.

-

The

contract will specify what stays and what goes (e.g., light fixtures,

drapes, appliances)

|

Your offer's cover letter

Begin your offer

with a cover letter that lists all of the documents you're including

and gives the deadline for the response and your contact

information. You should also try to justify your offer price,

perhaps by describing comparables nearby that sold for a low price.

|

Step 8: What to do if your offer isn't accepted

If

your offer is accepted, congratulations! But it usually won't be if

you've started with a low offer. Here's how to interpret different

reactions to an offer of, say, $830,000:

-

The

seller counters with $930,000. Sellers sometimes devise

counteroffers with the hope you'll offer to "split the

difference." In this case, the seller may be hoping you'll bid

$880,000. I recommend countering with

a lower value, say $860,000, and see what happens.

-

The

seller counters with a firm price of $910,000. A firm price means

the seller isn't willing to entertain a counteroffer from you. Since

paying $910,000 for the South Street house would leave me as well off as

I'd be if I paid $950,000 for the Bond Street house, I'd politely reject

the counteroffer and urge the seller to contact me if he or she had a

change of heart. Meanwhile, I'd make an offer on the Bond Street

house to see if I could get it for less than $950,000. If that

failed, I'd try to get the Cable Road house for less than $850,000.

(If I paid $850,000 for the Cable Road house, it would be equally

appealing as paying $910,000 for the South Street house.)

-

The

seller rejects the offer outright. There are several possible

reasons for this. Sometimes it's because the seller is entertaining

or expecting another, higher offer. Sometimes it's because the

seller hopes to press you into coming in with a much higher offer.

Sometimes it's because the seller is inexperienced, and is reacting

emotionally to what he or she perceives as an insulting offer. I

recommend urging the seller to reconsider and make a counteroffer.

Send signals that you like the house and that you're a serious buyer.

Sometimes

the seller is willing to bend on price, but not on something else. Some

friends of mine were involved in negotiations for a $700,000 that broke down

over whether the drapes would stay or go. If something (like drapes or

the move-in date) matters more to the seller than it does to you, it's wise to

bend.

What

to do when you want to come up with a fair price for both parties

If

the seller were willing to accept a minimum of, say, $860,000 for a house and

you the buyer were willing to pay a maximum of $910,000, then any price within that $50,000 gap

would make both of you better off. When negotiating a price, each of you

would normally use skill and cunning to capture as much of that

$50,000 as possible. But what if you and the seller aren't

evenly matched? What do you do if your opponent is elderly, sick,

desperate, poorly educated -- or a friend or relative?

In

these cases, I believe that you should abandon the game of negotiation and

simply try to find a fair price. Here's one way to do it:

-

With the seller, randomly select two appraisers and hire them to come up with

independent estimates.

-

Agree to sell the house at the average price, assuming the price is below the

maximum amount the buyer is willing to pay and above the minimum amount

the seller is willing to accept.

Advanced

negotiating tactics

-

Don't

fall for statements like these: "The price is $20,000 below

market." or "It's selling for less than the appraised

value." If the house can only sell for $600,000 in a market,

than that's the market value. If a house

is priced below the appraised value, then the appraisal must be

off.

-

If

you're working with a real estate agent, don't rely upon him or her for

advice about how much to offer. It's in the agent's interest for you

to make as high an offer as possible so that the offer is more likely to

be accepted and the commission to be paid. Figure out how much to

offer on your own.

-

If

you're working with an agent, try to convince him or her that your

bargaining position is strong. One way is to make a show of being

interested in more than one house.

-

If someone else is also looking at the property, give

the sellers just a day to respond. This can head off an alternative

offer.

-

If

things get bogged down, talk directly to the seller. Agents won't

like this, and some sellers won't want to talk with you. But this

might be an effective way of working out a deal.

-

If you can't break an impasse with a seller, consider making an

appraisal offer, in which you offer to pay the average appraised value

made by two

randomly chosen appraisers.

Next

topic: Closing

ŠLori

Alden, 2008. All rights reserved.

|

|